For cryptocurrency enthusiasts seeking mainstream adoption, events like this are so unhelpful.

Hackers appear to have made off with the equivalent of $2 million in digital currencies from Gatecoin, according to a notice posted on the exchange’s website. The Hong Kong-based firm admitted a security breach occurred between May 9 and 12 that allowed unauthorized access to its “hot wallets” holding both Bitcoins and Ethere (a Bitcoin rival). In total, the hackers were able to steal 250 Bitcoins and 185,000 Ethers, representing 15% of Gatecoin’s crypto-asset deposits.

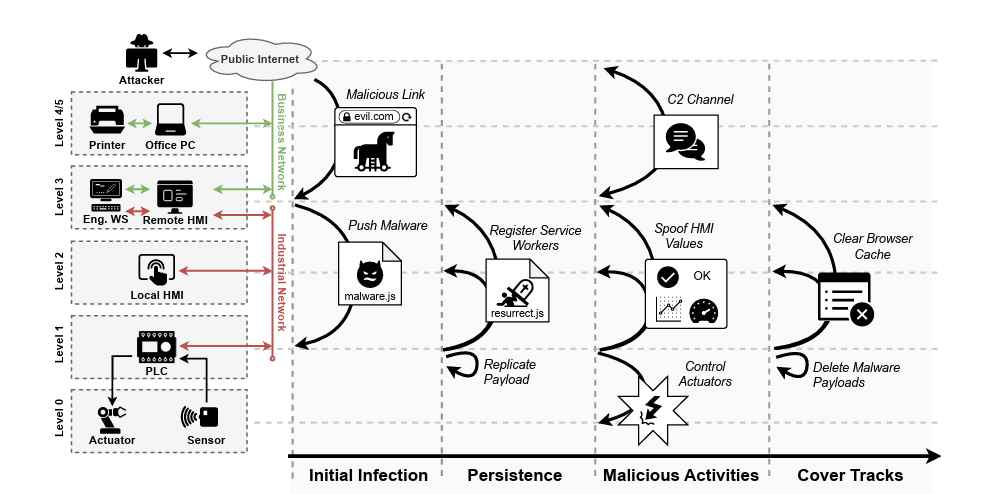

Cryptocurrencies are said to be more vulnerable when held in a hot wallet because they’re accessible on the web from any connected device. When they’re in “cold storage,” on the other hand, the private keys needed to transfer their value are held in a secure, offline device.

The details of how the hackers were able to pull off such a heist still have yet to be disclosed. Tehtri Security, a French cybersecurity firm, is said to be conducting a forensic investigation of the breach.

In a Reddit post from Friday, Gatecoin’s CEO Aurélien Menant said the investigation was taking longer than expected as they continue to focus on improving security for its other crypto-assets.

The post also stated that Gatecoin was trying to raise investment in order to reimburse all clients’ Bitcoin and Ether funds. The company’s target is to raise between $4 and $5 million to cover for the losses and to strengthen Gatecoin’s tech team with the aim of relaunching the exchange with a new security infrastructure.

Additionally, Menant has offered a bounty of 25% and lifetime free trading on the exchange for the return of any Ethers and Bitcoins that were stolen.

Gatecoin is an exchange and trading platform for a range of digital currencies. It was cofounded in July 2013 by Menant, a former investment banker with Societe Generale, J.P. Morgan and BNP Paribas . Menant is also a founding member of the Bitcoin Association of Hong Kong, which seeks to foster and promote Bitcoin and its technology.

“Criminals understand cryptocurrency better than almost anyone, which probably helps explain some of their success in this area,” Bryce Boland, Chief Technology forAsia Pacific at FireEye, said in an e-mail. “Unfortunately we’re going to see many more of these incidents before things get better.”

In recent years, thieves have successfully targeted a number of exchanges which are seen as attractive targets due to the large sums of currencies they routinely handle.

In April, cryptocurrency exchange ShapeShift admitted that it had become the victim of an inside job after reportedly losing some $230,000. First, an employee helped himself to 315 Bitcoins ($130,000) and then, after being fired, he sold information to a hacker who promptly stole another $100,000 in Bitcoins, Ethers and Litecoins.

China-based exchange BTER said that 7,170 Bitcoins ($1.75 million) were stolen in February last year in an apparent hack on its cold wallet system. The company didn’t reveal much about the theft except that it had occurred through a single transaction. At the time, BTER claimed to be the world’s largest trading platform for altcoins (Bitcoin rivals), with 230,000 registered accounts, including 130,000 Chinese users.

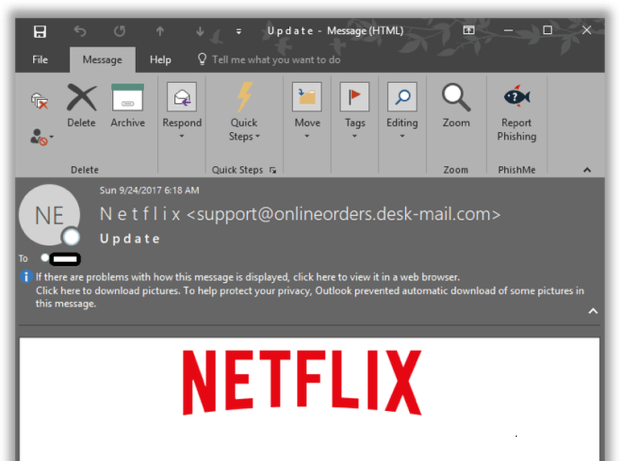

European exchange Bitstamp admitted to losing almost 19,000 Bitcoins ($5 million) a month earlier. The exchange which described itself to Forbes as “the backbone of the Bitcoin economy,” reportedly fell victim to its own employees unknowingly downloading malware through e-mail.

But it’s also worth noting that hackers aren’t just targeting cryptocurrencies. At least three banks have admitted to being attacked through the global messaging network Swift (Society for Worldwide Interbank Financial Telecommunication). As authorities continue in their efforts to recover the $81 million stolen by hackers from Bangladesh’s central bank in February, a bank in Ecuador recently admitted to having lost about $12 million in a similar fashion and a Vietnamese commercial bank narrowly avoided falling prey to some fraudulent requests late last year.

“Financial institutions are under siege by advanced cyber attackers, and even well-resourced established organizations can be compromised,” Boland added.

Source:https://www.forbes.com/

Working as a cyber security solutions architect, Alisa focuses on application and network security. Before joining us she held a cyber security researcher positions within a variety of cyber security start-ups. She also experience in different industry domains like finance, healthcare and consumer products.