According to computer forensics specialists, Brazil’s central bank has ordered the suspension of a newly implemented payment system where users of the Visa and Mastercard systems could make transfers via WhatsApp. In a statement, the banking institution mentioned that the implementation of this service without prior studies could negatively impact Brazil’s financial system.

Users could authorize banking through a chat in the messaging app and make payments to other individuals or local companies, attaching evidence such as photos or videos. That system had barely been released last week. Since Brazil is the second most important market for WhatsApp, Facebook decided to start this project here, although it does not seem to be waiting for it to be very successful.

This is a new setback for Facebook and its commitment to enter the world of finance; last year the company announced the launch of Libra, its own cryptocurrency that would receive the boost of the social media giant, as well as having a lot of partners supporting this project. However, regulators around the world have expressed concern about the large-scale use of this virtual asset, citing forensic computer specialists.

If Visa and Mastercard fail to comply with this measure, they could face severe penalties.

In this regard, a WhatsApp representative mentioned that they would continue to work with companies and local authorities to provide this system with the relevant security measures so that its use can be approved by regulators.

The main reason could be that WhatsApp implemented this system without the prior authorization of Brazil’s central bank, which has already announced its intention to collaborate in the improvement of this platform by issuing a regulation. Those involved would also require approval from private companies.

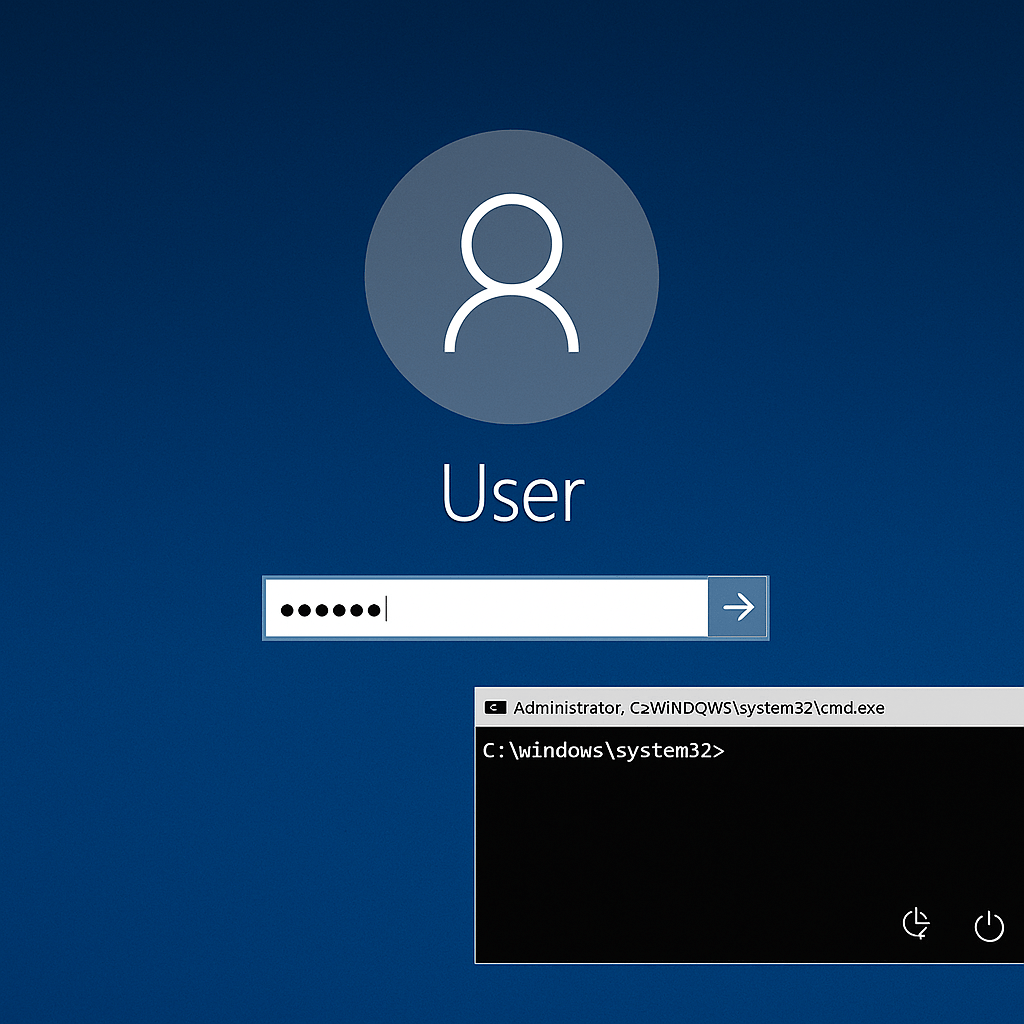

While some people believe this decision is somewhat exaggerated, forensic computer specialists consider WhatsApp’s intervention as a banking transaction intermediary to pose a significant security and privacy risk.

Another factor that has influenced is the future launch of Pix, the payment system developed by Brazil’s central bank, for which more than 900 partners are involved. As this system enlists, WhatsApp also announced its intention to integrate in the best possible way into the central bank’s plans.

For further reports on vulnerabilities, exploits, malware variants and computer security risks, it is recommended to enter the website of the International Institute of Cyber Security (IICS), as well as the official platforms of technology companies.

He is a well-known expert in mobile security and malware analysis. He studied Computer Science at NYU and started working as a cyber security analyst in 2003. He is actively working as an anti-malware expert. He also worked for security companies like Kaspersky Lab. His everyday job includes researching about new malware and cyber security incidents. Also he has deep level of knowledge in mobile security and mobile vulnerabilities.