Mobile users are increasingly turning to the use of apps to pay for their telephony, pay TV, streaming platforms and even credit fees. Still, many users may fall behind on their monthly payments, which have some consequences depending on the service to be paid.

While companies like Verizon offer users additional deadlines to cover their debts, other companies like Samsung India restrict multiple functionalities on delinquent users’ devices, a practice Google would be looking to replicate.

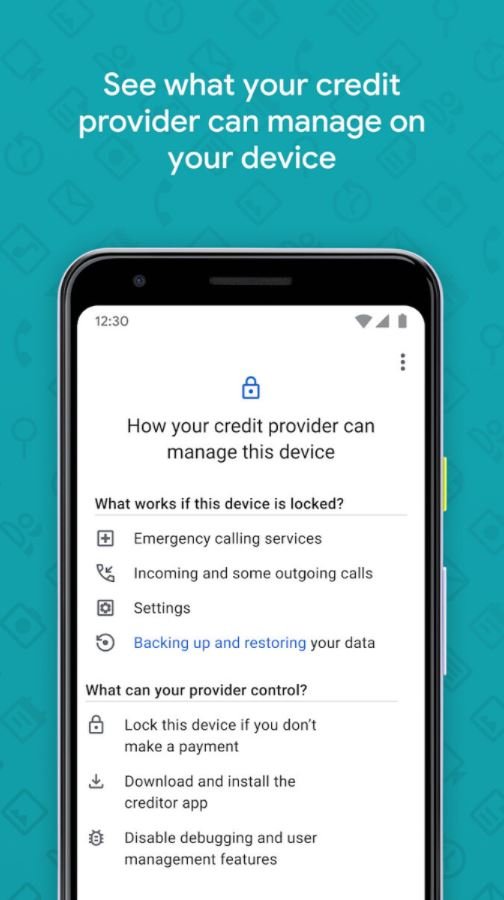

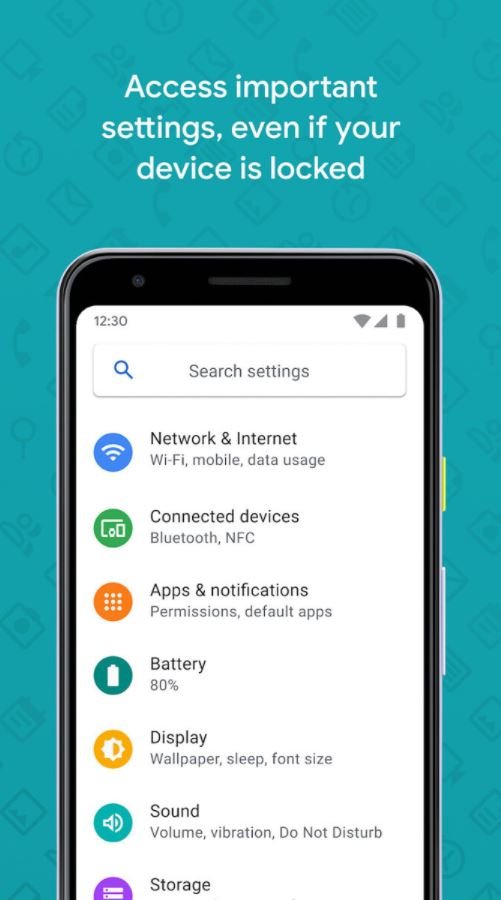

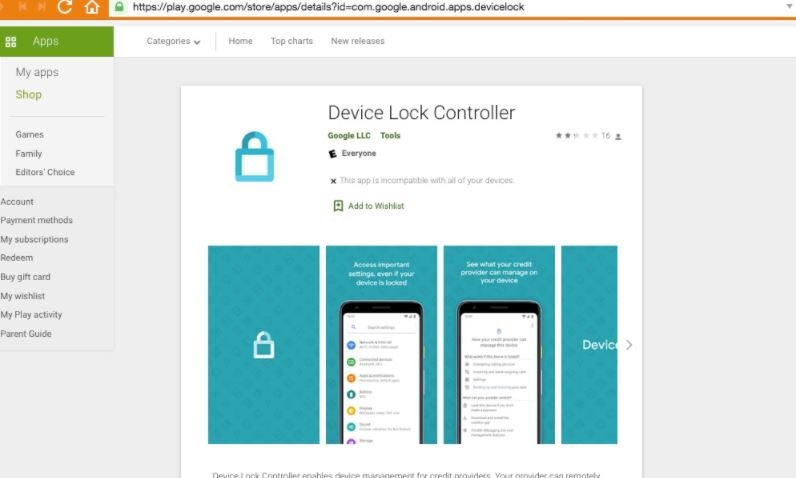

XDA experts recently released an analysis performed on “Device Lock Controller”, an app available on Google Play that would allow credit providers to manage devices remotely. In other words, your smartphone may be subject to restrictions on its functions if it does not cover your payments on time; features such as emergency calls or access to device settings would remain available.

The app uses the Android DeviceAdminService API to remotely control device functionality. Companies that deliver mobile devices to their employees resort to using this API, which is included by default and impossible to remove. Credit providers (banks, department stores, and other companies) can preload Google’s Device Lock Controller app before delivering a device to their customers, and if that customer is unused, the device will be remotely locked.

Device Lock Controller does not appear if you are searched in the Play Store; however, it is clear that this app was developed by Google. Obviously this has been a practice questioned by members of the cybersecurity community, considering it too invasive a tool. Regardless of the considerable investments of credit companies, mobile devices are too important a resource for people, so blocking them to avoid late payments is otherwise questionable. While users might still be able to make calls, all other features on their computer would be blocked.

He is a well-known expert in mobile security and malware analysis. He studied Computer Science at NYU and started working as a cyber security analyst in 2003. He is actively working as an anti-malware expert. He also worked for security companies like Kaspersky Lab. His everyday job includes researching about new malware and cyber security incidents. Also he has deep level of knowledge in mobile security and mobile vulnerabilities.