In the dynamic world of digital transactions, where convenience meets technology, there exists a silent adversary – online payment fraud. This digital menace poses a significant threat to the sanctity of online commerce, challenging the security of personal financial information and undermining the trust in digital payment systems. In this landscape, understanding the nature of online payment fraud, its implications, and the strategies for its prevention, is crucial for businesses and consumers alike.

Unraveling Online Payment Fraud

Online payment fraud involves illegal or unauthorized transactions made over the internet. It encompasses a variety of tactics used by fraudsters to deceive individuals or businesses, steal financial information, or disrupt transaction processes. This form of fraud can occur across various platforms, including e-commerce websites, online banking portals, and mobile payment applications.

More information: https://nethone.com/blog/what-is-online-payment-fraud-and-how-to-prevent-it

The Many Faces of Online Payment Fraud

- Card-Not-Present (CNP) Fraud: This occurs when stolen card information is used to make purchases online or over the phone.

- Identity Theft: Fraudsters use stolen personal information to carry out transactions or open new accounts in the victim’s name.

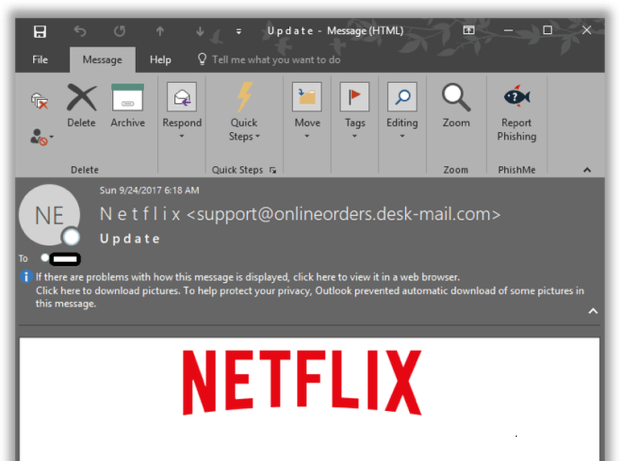

- Phishing Scams: These involve tricking individuals into revealing their financial details through deceptive emails or websites.

- Account Takeover: This happens when a fraudster gains access to a user’s payment account, changing login details and making unauthorized transactions.

- Merchant and Affiliate Fraud: Unscrupulous merchants or affiliates might engage in fraudulent activities, such as charging for goods never delivered.

The Ripple Effect: Implications of Online Payment Fraud

- Financial Losses: Victims, both individuals and businesses, can suffer significant financial losses due to fraudulent transactions.

- Reputational Damage: For businesses, frequent instances of fraud can lead to a loss of customer trust and damage to their brand reputation.

- Operational Disruption: Addressing fraud can be resource-intensive, diverting attention from core business activities.

- Legal and Compliance Issues: Failure to protect customer data can result in legal consequences and non-compliance fines.

Building a Fortress: Strategies Against Online Payment Fraud

- Robust Authentication Processes: Implementing multi-factor authentication can significantly reduce the risk of unauthorized access.

- Advanced Fraud Detection Systems: Utilizing AI and machine learning-based systems to monitor and flag suspicious transaction activities.

- Consumer Education: Informing customers about safe online payment practices and how to recognize fraudulent schemes.

- Encryption and Secure Payment Gateways: Ensuring that all transaction data is encrypted and secure from interception.

- Regular Security Audits: Conducting periodic assessments of security protocols to identify and address vulnerabilities.

Charting a Safer Path Forward

In conclusion, as the digital economy continues to grow, the challenge of online payment fraud becomes increasingly complex. Combating this threat requires a multifaceted approach that combines advanced technology, vigilant monitoring, and informed consumers. The future of safe and secure online transactions depends on our collective ability to stay a step ahead of fraudsters, safeguarding the integrity of digital commerce and maintaining the trust of its participants.

Working as a cyber security solutions architect, Alisa focuses on application and network security. Before joining us she held a cyber security researcher positions within a variety of cyber security start-ups. She also experience in different industry domains like finance, healthcare and consumer products.