After crimes in Taiwan and Thailand, the FBI warns of similar potential attacks in U.S.

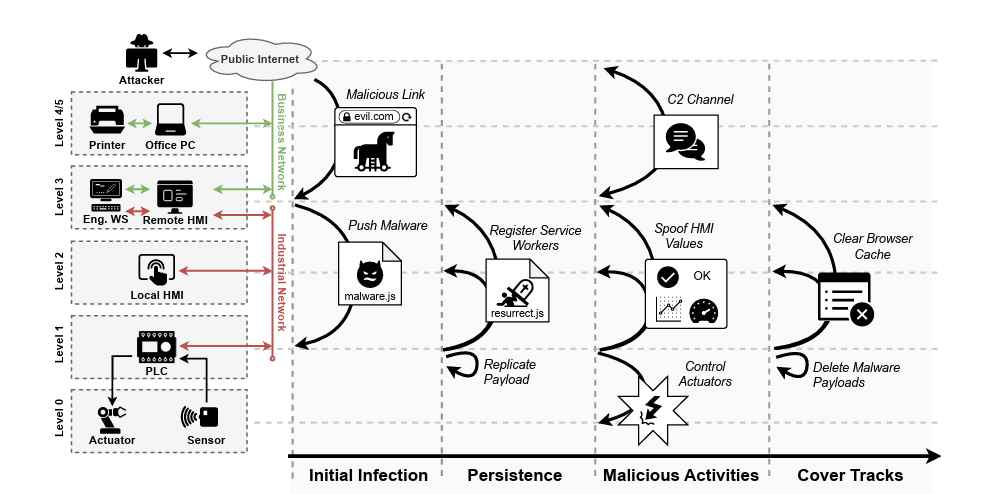

Cybercriminals who once earned millions by breaking into individual online bank accounts are now targeting the banks’ own computers, with often-dramatic results.

In Taiwan and Thailand earlier this year, the criminals programmed bank ATMs to spew cash. Gang members stood in front of the machines at the appointed hour and collected millions of dollars.

Earlier this month, the Federal Bureau of Investigation warned U.S. banks of the potential for similar attacks. The FBI said in a bulletin that it is “monitoring emerging reports indicating that well-resourced and organized malicious cyber actors have intentions to target the U.S. financial sector.”

Working as a cyber security solutions architect, Alisa focuses on application and network security. Before joining us she held a cyber security researcher positions within a variety of cyber security start-ups. She also experience in different industry domains like finance, healthcare and consumer products.